Unstoppable Healthcare Cost Pac-Man Gobbling Up Valuable Resources

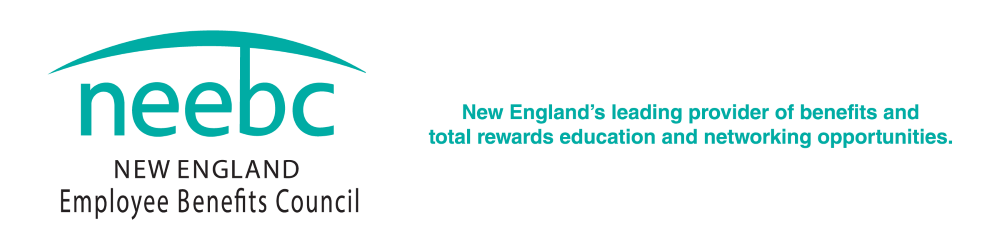

Unstoppable healthcare costs are eating up resources that companies and governments could better use to advance other important priorities. Healthcare rate increases will jump around 5% in 2021, according to a recent SHRM article. Not only does this hamper employers’ abilities to focus on their missions, but it also impacts HR departments’ ability to attract and retain employees by their attractive compensation and wellness offerings.

Unstoppable healthcare costs are eating up resources that companies and governments could better use to advance other important priorities. Healthcare rate increases will jump around 5% in 2021, according to a recent SHRM article. Not only does this hamper employers’ abilities to focus on their missions, but it also impacts HR departments’ ability to attract and retain employees by their attractive compensation and wellness offerings.

The go-to strategy of moving employees to high-deductible health plans has inadvertently created adverse financial and health consequences. The Mass Health Policy Commission reports that 46% of the state’s adults skipped needed healthcare in 2019 due to unaffordable out-of-pocket costs. The numbers were especially alarming for low-income and people of color, but even high-income people were not immune. A new study from Gallup and West Health showed similar results.

Why Are Healthcare Costs Rising?

“Value-based care is an elusive goal and has been for many years,” said Karin Landry, Managing Partner at Spring Consulting Group at NEEBC’s December 2021 Healthcare Risk Management Solutions Program. She brought attention to the following factors that are driving up costs:

- Higher provider charges to commercial payers to offset lower payments from Medicare and Medicaid

- An aging population

- The effects of COVID on access to and deferral of care

- The market consolidation of insurers, pharmacy benefit managers, and pharmacies

- Pharmacy benefit management controlled primarily by three vendors

- Rising prescription drug costs

- An increased need for behavioral health services

Which Tactics are Employers Using to Manage Healthcare Risk?

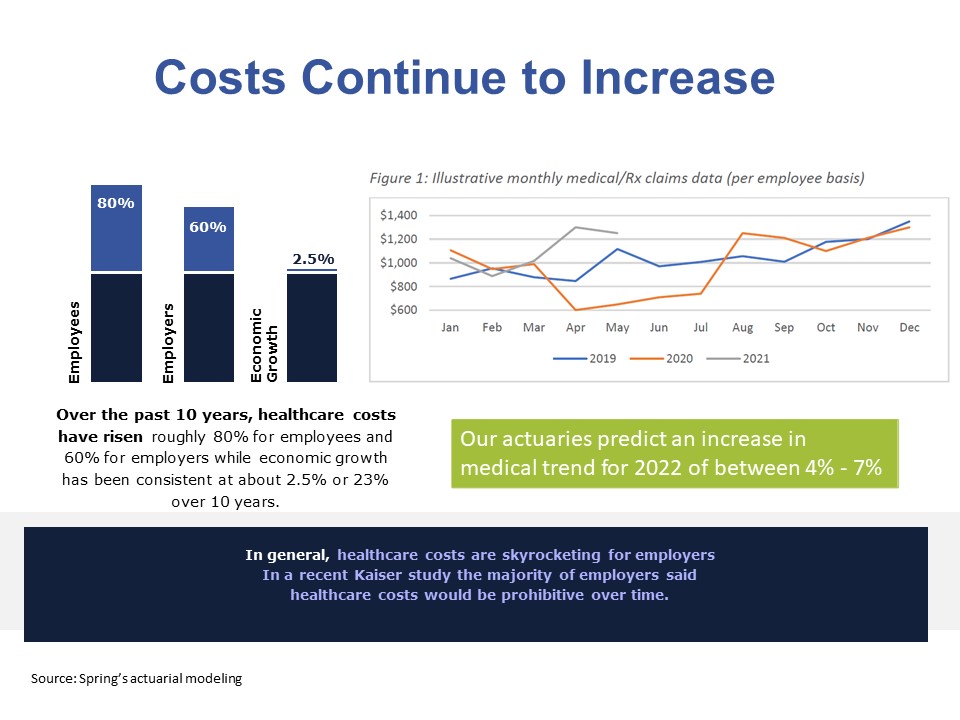

“During the peak of the pandemic, self-insured employers were the winners when claims dramatically dropped and employers weren’t locked into paying costs that weren’t warranted,” said Karin. “Conversely, fully insured health plans benefited over their employer purchasers.”

The benefits of a fully insured healthcare arrangement include:

- Traditional insurance approach – easily understood and most common for small and medium groups

- Insurance carrier is responsible for the risks

- Easier for budgeting

The benefits of self-insurance include:

- Increased insight into spending trends

- Insurer profit, premium tax, and administrative fee savings

- Improved cash flow

Nationally, 67% of employers have self-insured healthcare arrangements, according to the Kaiser Family Foundation. For Point32Health (the combined Harvard Pilgrim Health Care and Tufts Health Plan organization), 45% of their business is self-insured. Beth Roberts, President of Commercial Business for Point32Health, who moderated the NEEBC Solutions panel discussion, noted that the lower rates of self-insurance go back to the plan roots as an HMO. “Our ASO (Administrative Services Only) self-insured business is growing and our TPA business is growing even faster with a double-digit growth trend,” she said.

“Small employers are now looking at group purchasing, captives, and MEWAs (Multiple Employer Welfare Arrangements) to help them move to self-insurance and manage risk,” said Karin. “A captive is a special purpose insurance company that an employer or groups of employers establish to manage their own risk – generally to leverage better stop-loss rates.”

MEWA capital and surplus requirements and self-insurance rules vary by state. With a $1 million surplus requirement, it is difficult for employers to set up this option in Massachusetts. Although reference-based pricing that pays doctors, labs, clinics, and hospitals a percentage of an established Medicare benchmark is popular in Texas, it hasn’t yet gained traction in the Northeast. Defined contribution plans (where employers contribute a set annual dollar amount per employee for all health care coverage) are also a growing trend in other areas of the country.

Digging into your healthcare data to determine which approaches to take to control claims is a good strategy. For example, if you have wide disparities in what you pay for a hip replacement, establishing second options and a Centers of Excellence (CEO) program is an attractive option. Fifty-one percent of employers are incorporating CEO and second opinions into their strategies, according to recent Alera healthcare benchmarking survey results.

Point solutions allow for better managed delivery of care for certain disease states. “Plan administrators have limited mental health network participation, and digital solutions add capacity,” said Karin. “The challenge is to figure out which solutions will make a difference.”

3 Cutting-Edge Risk Management Levers That Unlock Savings

1) Captive Arrangement Solutions

“The administrative and stop-loss savings for a captive can be as much as 25%,” said Karin. A captive is an owned insurance solution. An employer can own its own captive similar to owning a home. A group captive is a group of common entities that come together to insure their own risk with an outside entity managing it. This structure is like a condo association.

edHEALTH, a captive comprised of 25 colleges, universities, and secondary schools is an example of a group captive. “Sixty percent of a higher education institution’s budget goes to salary and benefits, so containing these costs is crucial,” said Nancy McConaghy, edHEALTH’s Vice President. “A captive arrangement gives employer organizations more control over and better transparency into their long-term risk.”

After conducting a feasibility study, a group of colleges and universities in Massachusetts selected a captive arrangement to bring down rising faculty and staff healthcare costs. This solution included all the benefits of self-insurance with better administrative, stop-loss, and prescription drug program pricing.

edHEALTH’s 7-year average premium increases of 2.9% is substantially better than the plan carriers’ book-of-business 7.9% average. “Our administrative fees of 3.7% are better than the industry average of 8%,” said Nancy. She recommends to others considering a captive arrangement:

- Define your objective

- Ensure appropriate funding

- Focus on loss control and claims management

- Make a long-term commitment

- Contract with strong business partners

- Expect the process to take longer than anticipated

Some captives are owned by brokers with some or all profits going back to the broker. “An advantage of a member-owned captive like edHEALTH is that all of the profits go back to the member organizations,” said Nancy.

2) Pharmacy Benefit Program Solutions

Prescription drug costs grew 4.9% in 2020 and will rise another 4%-6% in 2021, according to the American Society of Health-System Pharmacists. Utilization and new drugs are fueling these increases. Prescription drug costs represent 18% of total employer healthcare costs, with an additional 10% incurred within employers’ medical claims.

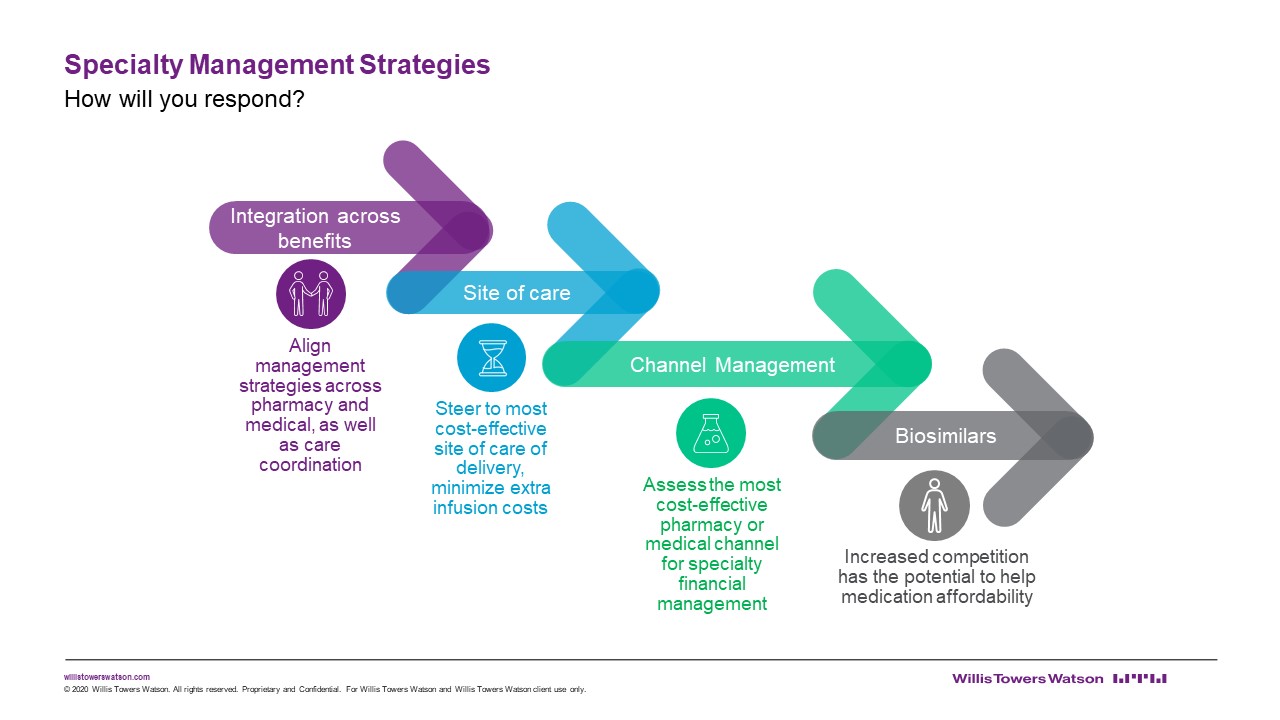

Sixty-three percent of employers carve out pharmacy benefits from their medical plan, according to a 2021 Willis Towers Watson survey. Many employers are considering new solutions to deliver cost savings:

- 1 in 6 considering importing or allowing access to pharmaceuticals sold outside of the U.S.

- 1 in 4 considering group purchasing with other employers

“The larger you are, the more bargaining power you have, especially with only three main PBMs,” said Paul Lakomski, PRPH MBA, Senior Pharmacy Consultant, Willis Towers Watson. “A collaborative is a method for smaller groups to attain this size.”

PBM contract transparency is a hot topic. “One concern about PBM (Rebate) Group Purchasing Organizations (GPOs) is lack of transparency,” said Paul. “They have added an extra layer into the system that adds more opacity.” He recommends keeping auditability in mind as you evaluate your PBM options. State level legislation attempting to bring more transparency to the PBMs, while well-intentioned, will cause costs for employers — and ultimately patients — to increase.

Managing Specialty Drug Spending

It’s critical to manage specialty drug spending. Sales of Humira alone exceeded $5 billion in the fourth quarter of 2020. Some of this is going back to purchasers in rebates and PBM coupon programs, but the amount spent has a big impact on purchasers.

Precision medicine offers hope for patients but is costly. The 2021 WTW survey found that:

- 28% of employers cover gene therapy and 9% are considering coverage

- 47% of employers have stop-loss coverage to protect against high-cost gene therapy claims

“Gene therapy is like a lightning strike, unlikely, but very damaging if it happens,” said Paul. “A potential hemophilia cure may cost $3 million per patient.” Precision financing, like risk pooling, orphan reinsurers/benefit managers, and stop-loss can help control an employer’s risk.

Biosimilars have the potential to help slow spending. “Biosimilars aren’t generics, they’re a highly similar product to the specialty drug, more like a brand name drug,” said Paul. “Expect biosimilar savings for a particular drug in the 10%-15% range to start.” Multiple manufacturers will produce biosimilar versions of Humira in 2023, the uptake of these biosimilars is hard to predict but they will have an impact on cost. He encourages employers to develop their biosimilar strategy.

The Institute for Clinical and Economic Review (ICER) objectively evaluates the clinical and economic value of prescription drugs, medical test, and other healthcare and healthcare delivery innovations. The European Union is using ICER’s value-based pricing to assess drug costs. In the U.S., PBMs and health plans use ICER’s price benchmarks for coverage decisions. “Although employers aren’t directly using ICER to determine coverage or pricing, it’s starting to gain traction as an option,” said Paul. He encourages employers to work with their plan administrator and advisor to explore how it can be used to help benefit decision-making.

3) Data Management Solutions

Digging into your healthcare data reveals stress points and opportunities for improving health quality and costs. Hallie Pierson, Senior Director, People and Culture for 2seventybio recommends a multi-pronged approach that combines data integrity, organization action, and stakeholder buy-in. “When reviewing your data, define the questions you want to answer, distinguish information from action, and deliver a clear story,” she says.

At one of Hallie’s previous employers, healthcare data revealed that emergency room use had skyrocketed and employees were not visiting their primary care provider (PCP). After investigating the cause, Hallie’s team found that the reason for this phenomenon was that PCPs require a copay upfront and ERs don’t. “Employees couldn’t afford the upfront payment,” said Hallie. “Our solution was to reimburse copays and put in a telehealth PCP program.” The program generated savings of $1 million.

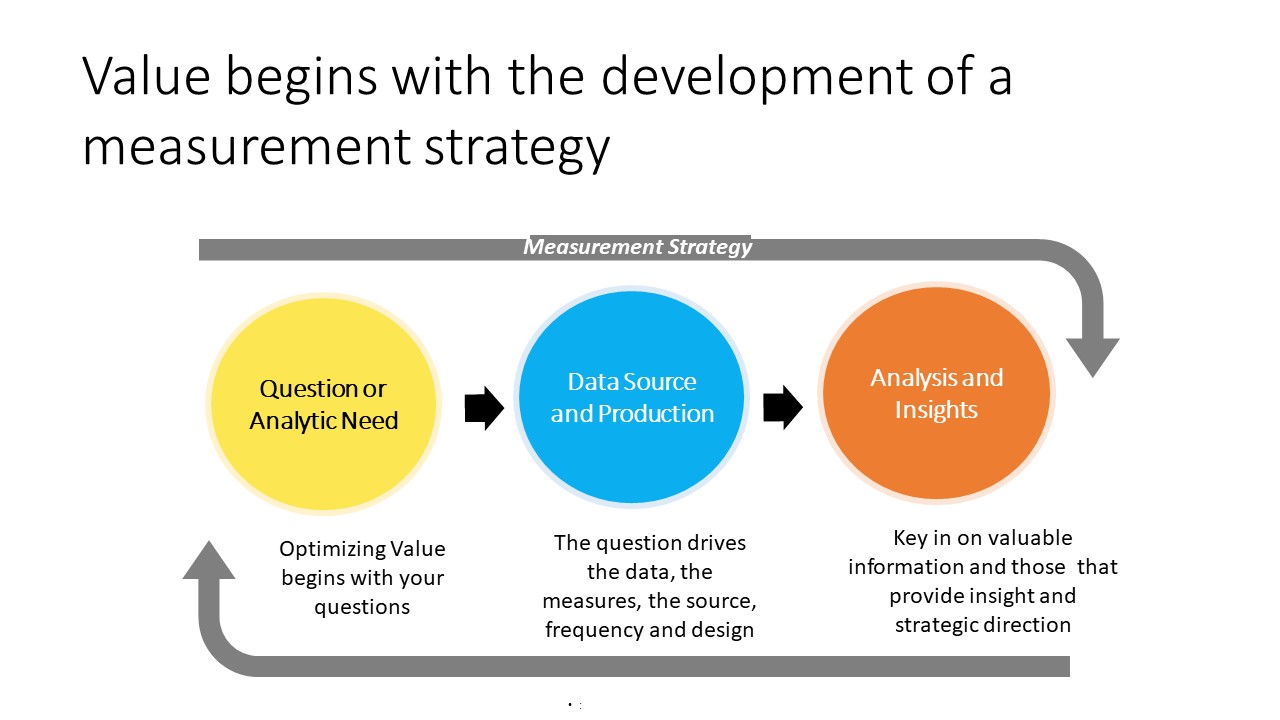

To optimize value, determine your questions and analytic needs advises Hallie. This will drive the data selection, measures, source, frequency and design. Focus on information that provides insight and strategic directions. You may need multiple data sources to get the answers you need: plan administrators including ancillary leave/disability and point solution vendors; HR; warehouse firms; and consultants with analytical and clinical expertise.

“One of our work sites was a rural plant in Kentucky with very high pregnancy costs and higher-than normal C-section rates,” she said. “After digging into the data and surveying the workforce, we discovered that pregnant women didn’t have a way to get from work to their prenatal care.”

The company instituted free van transportation once a week plus time off for pregnant workers to get to their doctor office. “It wasn’t an education issue, it was an equity issue,” she said. The initiative generated a significant return on investment.

The Time to Plan for 2023 is Now

Rising healthcare costs will continue to eat up resources in 2022, and early projected trends for 2023 are alarming. Now’s the time to plan for your 2023 employee healthcare benefits strategies. The Health Policy Commission identifies additional causes of rising healthcare costs:

- Large provider groups’ capital project expansion that disrupts community-based care

- Inequitable access to care and the corresponding impact on health

- Provider billing upcoding to charge more per patient

- Provider consolidation and the market leverage this creates

- Increased utilization of outpatient hospital services

Tackling these cost drivers is a topic for another day, but in the meantime the above risk management solutions give us plenty to dive into.

Cynthia McGrath provides marketing communications and employee engagement consulting services to healthcare organizations, benefits consultants, and educational institutions.